Elliott Wave Scanner Tools: Are They Reliable?

Elliott Wave analysis is often considered an art form. But what if software could scan charts and label waves for you automatically? That’s the idea behind Elliott Wave scanner tools—platforms that identify wave structures based on predefined rules and algorithms.

In this post, we’ll explore how these scanners work, their pros and limitations, and how to use them wisely in your trading strategy.

What Are Elliott Wave Scanner Tools?

Elliott Wave scanner tools are programs or indicators designed to:

- Automatically detect wave patterns

- Label impulse and corrective structures

- Scan multiple assets and timeframes for setups

- Suggest potential entry or exit points

These tools are available as standalone software or plugins for platforms like TradingView, MotiveWave, or MetaTrader.

Popular Elliott Wave Scanners

1. WaveBasis

- Cloud-based scanner with real-time wave detection

- Offers high-probability trade signals

- Great for beginners and fast analysis

2. MotiveWave Auto Analyzer

- Advanced auto-labeling engine

- Supports multi-degree analysis and strategy testing

- Suitable for professional traders

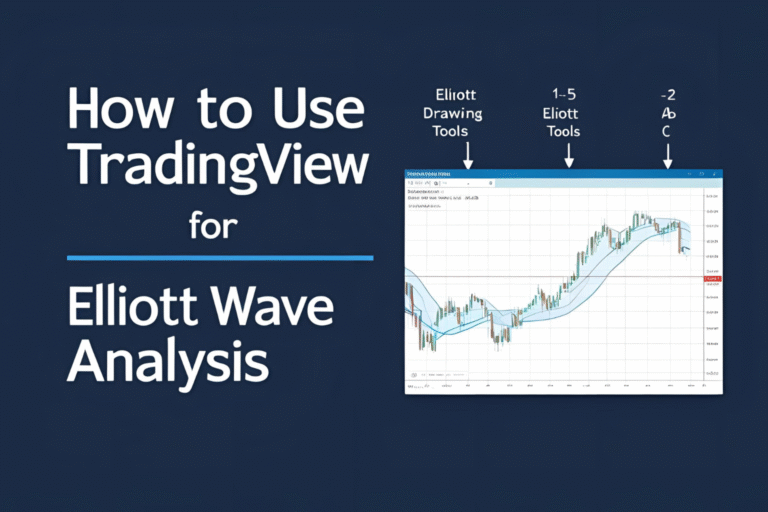

3. TradingView Custom Scripts

- Community-built Elliott Wave indicators

- Vary in quality and accuracy

- Good for experimenting with basic auto-labeling

Benefits of Using a Wave Scanner

- Time-saving: Instantly identifies potential wave setups

- Consistent application of rules: Removes emotional bias

- Multi-timeframe analysis: Scan hourly, daily, or weekly charts

- Backtesting: Some tools allow testing wave-based strategies

These features are especially useful for traders monitoring dozens of assets.

Limitations and Risks

- Subjectivity: Elliott Wave theory has interpretive elements scanners can’t fully grasp

- False positives: Not all detected patterns are valid

- Overreliance: Blindly following scanners can lead to bad trades

- Missed context: Scanners may ignore key fundamental or macro factors

Always treat scanner outputs as starting points, not final decisions.

Best Practices When Using Scanners

- Validate wave counts manually

- Combine with volume, RSI, or MACD

- Use higher timeframes to confirm structure

- Compare multiple tools before acting

- Keep an alternate scenario ready

Scanners can help—but you remain the analyst.

Conclusion

Elliott Wave scanner tools can be valuable time-savers and decision aids, but they’re not foolproof. Use them to support—not replace—your analysis. When combined with experience and confirmation tools, scanners can enhance your accuracy and speed in spotting profitable setups.

FAQs

Do Elliott Wave scanners always give accurate counts?

No. They follow rules but can mislabel waves due to market complexity.

Are scanner tools good for beginners?

Yes, if used as a learning tool alongside manual analysis.

Which scanner is best?

MotiveWave is best for pros. WaveBasis offers a user-friendly option for newer traders.

Can scanners predict future price movement?

They identify probable structures, but outcomes still depend on market conditions.

Should I trade directly off scanner signals?

No. Always confirm patterns with other technical indicators and manual review.